Amended the reduced pension calculations in order to consider diferent factors Checked and Agreed more info B Your benefits \\GAD\DATA\a2clients\Police Pensions\ Home Office Police\Cost Ceiling\Pension estimator\Pension calculator v018xls Matt Wood Changes to the notes No changes to calcs Please enter the following details about yourself 1 So 28 years will give a pension of just under £19K Obviously if you don't earn that then you'll need to extrapolate the correct amount to give you the right figure for your earnings You obviously have a calculator for the 1995 pension;NHS Pension Calculator A pension scheme for working English NHS people It was founded in 1948 and administered by health department, UK This online calculator lets you know your pension based on the National Health Service Pension Scheme in UK Enter the required details into the calculator to know your annual pension, lump sum retirement allowance, reduced pension

Short Guide To The Firefighters Pension Scheme Fps Pdf Free Download

Nhsbsa additional pension calculator

Nhsbsa additional pension calculator-Responsible for the administration of the NHS Pension Scheme for England and Wales The administration of the Scheme includes calculation of benefits, collection of contributions from employers, maintenance of member records and payment of benefits The costs of administering the Scheme are met by the NHSBSA, which is in turn funded by the The NHS pension scheme will not necessarily know if you are subject to tapering and if you are subject to the taper you should request a statement NHSBSA (England and Wales) and the HSC (Northern Ireland) will automatically issue statements if the combined growth between the 1995/08 and 15 schemes exceed the standard annual allowance

Pensions Tax And Pay My Supporrt

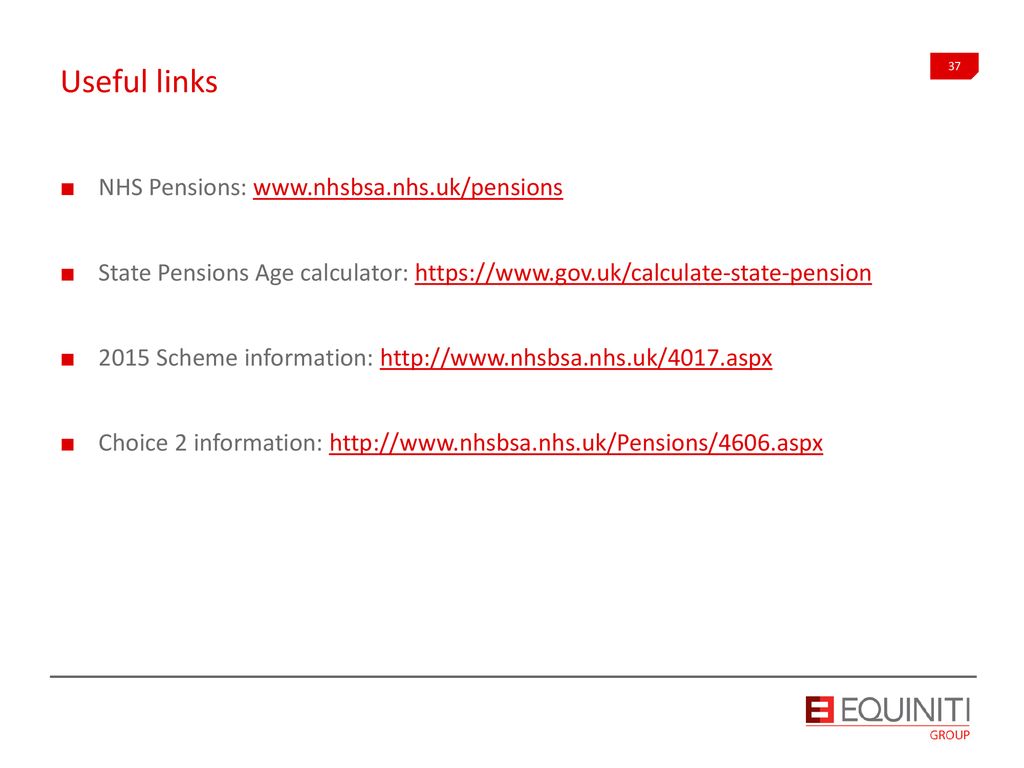

The process for applying for Additional Pension is as follows After getting a quote from the Additional Pension calculator found here click the create form button which will give you an AP1 form pre populated with the quote details to print off;Pension Services Our NHS Pension Scheme guidance and support delivers expertise and efficiencies to NHS organisations and their workforces that may not be available inhouse Partnering with some of the largest forwardthinking NHS organisations, our expert team offers specialist knowledge and support to NHS employees, helping to quicklyHow is the pensionable earnings credit calculated?

Your pension is calculated as follows uprated earnings x 14% Your retirement lump sum is normally three times the pension As an example, a GP retires at age 60, her earnings for each of the years as a practitioner are revalued and added together giving anMake contribution payments to the NHS Pension Scheme Finance login Finance login Login details Username PasswordNHS Pension Calculators This is where you will find several calculators to assist you in working out the payments and benefits that your NHS pension is associated with Please be fully accurate in your input to obtain the clearest possible results There are three calculators available

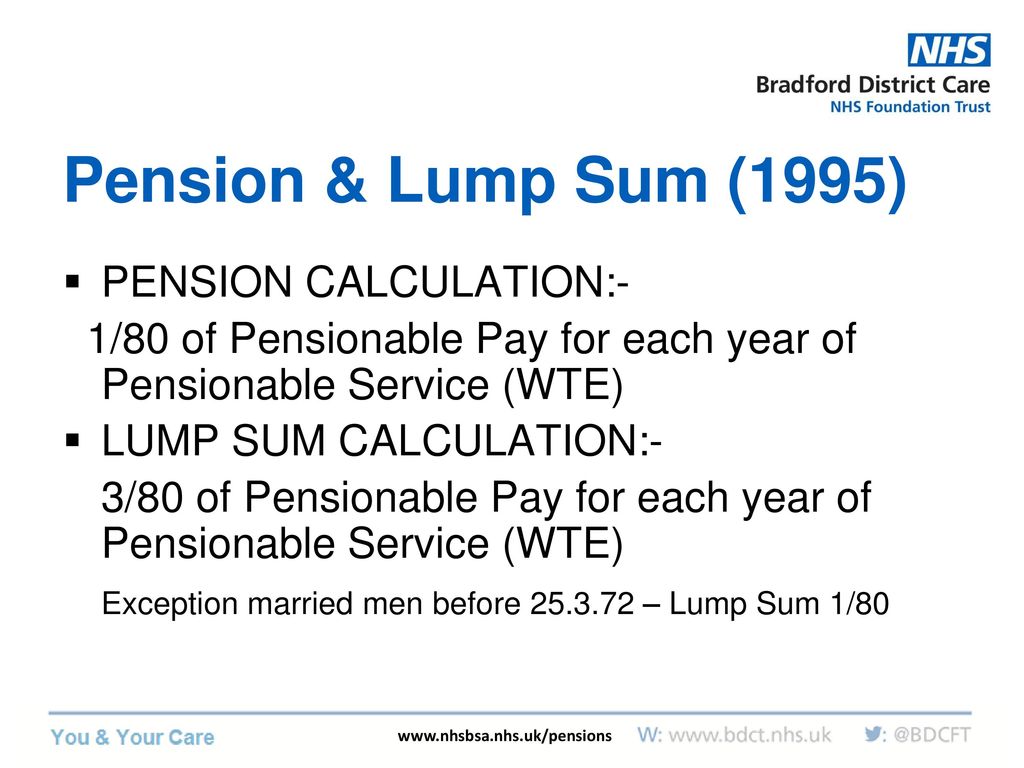

In the 15 Scheme the build up rate is 1/54th, so you earn a pension each year of 1/54th of your pensionable earnings Your pension earned each year will be increased each year by a rate, known as 'revaluation', in the period before you retire or leave The revaluation rate is determined by Treasury Orders plus 15% each yearViews Most Recent Articles Which application forms should be completed when a Scheme member dies?Your annual pension is equal to oneeightieth of your final pensionable pay for each year and part year of Scheme membership The calculation is as follows × final pensionable pay × years of membership* 80 For example, 5 years and 213 days of membership is equal to

Applying For Your Pension Nhsbsa

Www Judiciary Uk Wp Content Uploads 13 08 Principles Second Revision Pdf

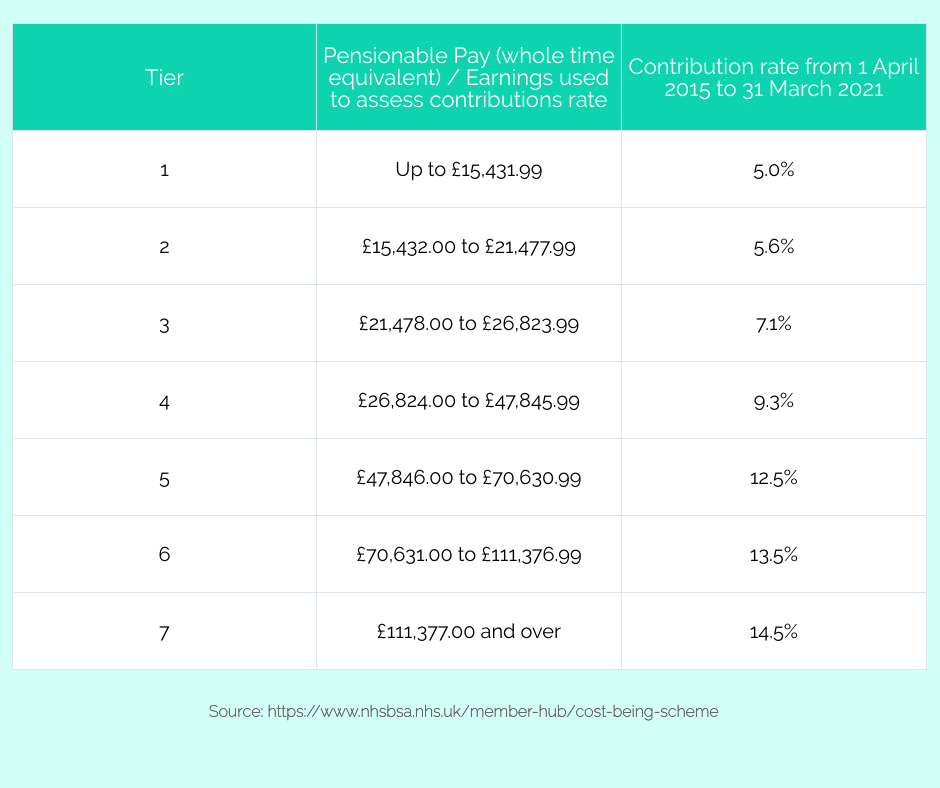

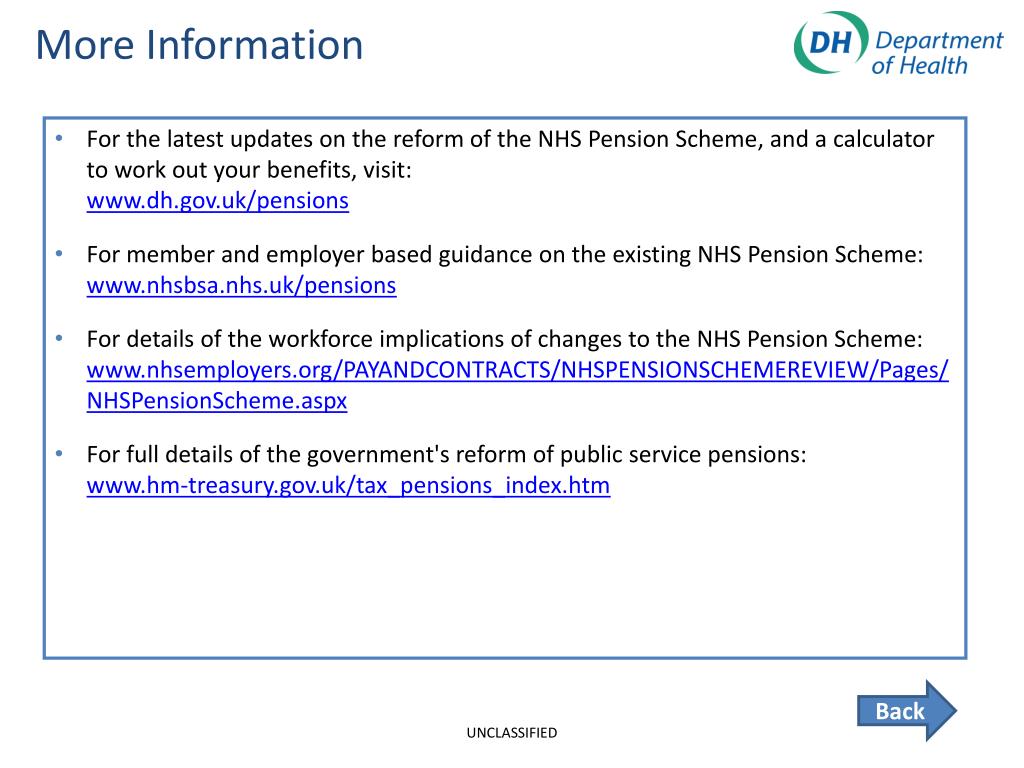

NHS Pension Scheme The NHS Pension Scheme is a defined benefit public service pension scheme, which operates on a payasyougo basis A new reformed scheme was introduced on 1 April 15 that I have taken a reasonably typical GP client of ours and calculated pensions and AA liabilities under the current arrangements and again if remedy period benefits revert to the 1995 scheme The GP is 52, from a decent earning practice, although not extreme, and has an added years contract From 16/17 to 19/ a tapering of the AA happened in three of the four yearsStandard Pension Calculator Instructions Your answers 1 Enter the age at which you intend to retire If this is earlier than your normal pension age (60 for most members, or 55 for special class members) your pension and lump sum will be reduced before being paid Both the unreduced and reduced benefits are shown below

Www Sath Nhs Uk Wp Content Uploads 04 W26 1 Nhs Pension Scheme Pdf

Form Sd502 Download Fillable Pdf Or Fill Online Application To Leave The Nhs Pension Scheme United Kingdom Templateroller

21 Annual Main Certificate of Pensionable Profits Guidance2101(V1) 4 website (including the GP Pension Guide) and the spreadsheet calculator to assistViews Most Recent Articles What do I do if I am unable to log into Make Contribution Payments?You can obtain a quotation via the Additional Pension (AP) calculator on our website If you decide to go ahead with the additional pension purchase you then print off the quote / price (form AP1) and send this in Address Pension Administration, 1

Tapered Annual Allowance What Nhs Pension Members Need To Know Juniper Wealth Management

Wd Nottinghamcitycare Nhs Uk Media 1150 Admin Pensions Pdf

Hi I am hoping that someone can help me I retired from the NHS last October I based my decision to retire and take a lump sum on the figures supplied to me by NHS pensions (NHSBSA) My pension lump sum was paid on my 55th birthday last December and I have been getting a monthly annuity I received out of the blue this morning 2 letters from NHS pensionsOptions on leaving the NHS Pension Scheme opting out, refund or transfer out Skip to main content Skip to footer NHSBSA Use the opt out calculator (Excel 69KB) to understand the impact on your take home pay It will also give you some information about the benefits you would lose if you decide to opt out Read the opting out factsheet (PDF 162KB) for more informationA salary sacrifice in the period used to calculate retirement benefits will impact on the amount due For staff who have Tapered Protection, ie based on how many months beyond 10 year of normal pension age at 1st April 12 For each month beyond 10 years, the tapered protection end date of 31 March 22 is reduced by two months

Www Gmb Org Uk Sites Default Files Guide to nhsps Pdf

Nhs Pension Annual Allowance

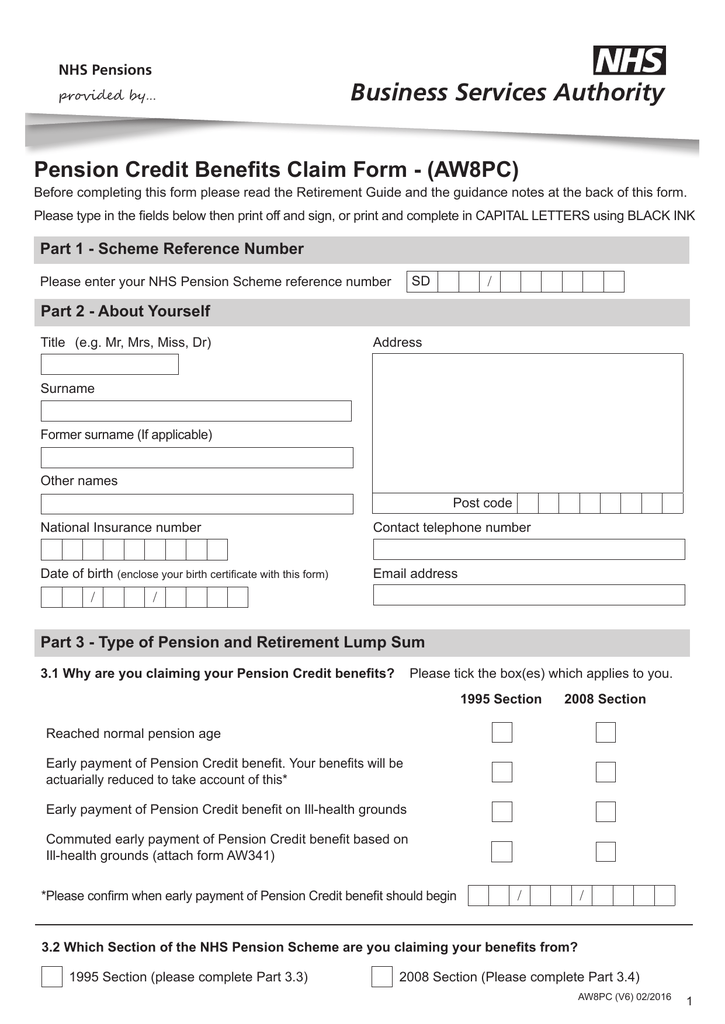

Pension for cash at retirement, up to 25% of capital value Some members may have a compulsory amount of lump sum 3 x pension Option to exchange part of pension for more cash Option to exchange part of pension for cash at retirement, up to 25% of capital value Some members may have a compulsory amount of lump sum 3 x pension Option to A saving or cost should be then calculated using CER 4 or CER5 The overall cost to the Employer allowing for the adjustment of deffered PI should be greater than or equal to £0 NHS Pension Scheme (E&W) Early Retirement Factors Benefits Payable to the Member on ARER 1995 Scheme (NPA 60) Table ERF 1 Table ERF 7 Date of Birth Pension Age Benefits Payable to the Public service pension scheme consultation response – the McCloud judgment FAQs views What form do I complete to claim my NHS Pension?

Elfs Payroll Pensions Frequently Asked Payroll Faq S 14 15 Pdfelfs Payroll Pensions Frequently Asked Questions East Lancashire Hospitals Trust By Email On Elfs Helpdesk Elht Nhs Uk

Assessing Annual Allowance Ready Reckoner Tool And Demonstration Nhs Employers

Pension statements refresh yearly, based on information supplied by your employer up to 31 March Find out more on our Total Reward Statement information website Early retirement calculator The early retirement calculator shows what to expect if you claim benefits earlier than normal pension age You'll need to access your Annual Benefit Statement to use the calculator The calculatorAdditional Pension Calculator About you About your additional pension Date of birth * To be payable from * 60 65 SPAViews Most Recent Articles What do I do if I am unable to log into Make Contribution Payments?

The Nhs Pension Scheme Doctors Relocate

Nhs Pension Scheme Pension Flexibility Response To Consultation Gov Uk

The transfer value from your previous pension scheme is multiplied by 54 and the total amount divided by the factor supplied by our Actuaries which is dependent on the member's age, and their Normal Pension Age (NPA) You earn a pension of 1/54th of the pensionable earnings creditNhs pensions nhsbsa Calculators – hsc pension service 'should i retire at 55 because of my £1 25m nhs pension?NHSBSA NHS Pensions The NHS Business Services Authority (NHSBSA) is a Special Health Authority and an Arm's Length Body of the Department of Health and Social Care (DHSC) We provide a range of critical central services to NHS organisations, NHS

Www Hee Nhs Uk Sites Default Files Documents Taking personal responsibility for your nhs pension Open Pdf

Short Guide To The Firefighters Pension Scheme Fps Pdf Free Download

The information below shows how the Tier 2 benefits are calculated in each of the NHS Pension Schemes In the 1995 / 08 Scheme, Tier 2 is entitlement to the retirement benefits you have earned to date enhanced by two thirds of your prospective membership up to reaching your Normal Pension Age (NPA) * In the 15 Scheme, Tier 2 is entitlement to the retirement benefits youPension benefits already built up in the 1995 and 08 sections will be retained and calculated by reference to your final pay at retirement You will still need to retire from NHS employment in order to access your 1995 or 08 section benefits You will not be able to access your 15 benefits without reduction for early payment until your normal pension age for the 15 pension scheme Public service pension scheme consultation response – the McCloud judgment FAQs views What form do I complete to claim my NHS Pension?

Www Elfsnhs Co Uk App Uploads 06 Nhs Pensions Faqs Pdf

Http Thurrockccg Nhs Uk About Us Document Library Board Papers 14 Archive April 14 303 Item 04ac Nhs Pensions Employee Newsletter File

How to calculate provider and performer NPE / NPEE Date April 18 2 A practice must notify the relevant organisations of GDS/PDS income that is non pensionable for the purposes of calculating maternity pay, etc If the practice is a limited company, the provider can only pension income that isYou must create an AP1 application form using the calculator on our website, print it off and fill in the rest of the details requested in Part How to calculate your benefits To get a quick estimate of the benefits your NHS pension scheme will provide on any retirement date selected by you, just download our handy calculator It's a Microsoft Excel file and covers the needs of most* members of the 1995 Section, the 08 Section and the 15 Scheme as well as members who have

Http Www Cardiffandvaleuhb Wales Nhs Uk Sitesplus Documents 1143 Trs staff faqs Pdf

Nhs Pensions Annual Allowance Further To Guidance Issued On 10 October 19 We Would Like To Update Members On Annual Allowance Statements T Co Ycxaaoijnm T Co Ef9h4b0gls

NHSBSA Search Search NHS Pensions We're responsible for administering the NHS Pension Scheme in England and Wales Member hub Information for members of the NHS Pension Scheme Employer hub Information for employers of the NHS Pension Scheme Pensioner hub Information for NHS pensioners, surviving spouses, partners or dependants Changes to public service pensionsCall Drivers Agent Login * 6*** Number Call Stream * Dental Prescription Services Pensions Payroll Pensions Member TRS Pensions Employer Student Bursaries LSF Previous LSF SWB LIS PECS DECS OHS PPC Tax Credit MedEx MatEx NHS Jobs NSDR IHS Healthy Start MHRA Dental Primary * ActivityNHS Pensions Scheme Identifier Welcome to our Scheme identifier This tool is designed for members who are currently contributing to the Scheme This tool will help you to identify what type of NHS Pension Scheme member you are and whether the April 15 NHS Pension Scheme changes affected which Scheme you are in The Scheme identifier works

8 Key Takeaways The Nhs Pension For Absolute Beginners

Http Www Fairwaytraining Com Downloads Pips Pips No11 Pdf

Final salary pension calculator Enter your details below to get an estimate of what your pension income could be if you have a final salary or defined benefit pension Annual income before tax Number of years in service Please select your accrual rate below Accrual rate 1/ Calculate Your final salary pension estimate is This is only an estimate based on limited information, designedWhen calculating the transfer value of your pension benefits for a transfer out of the NHS Pension Scheme, various factors are taken into account These include your age, pensionable pay and your membership of the Scheme The transfer value is normally guaranteed for three months, after that if any of the various factors change for example, you Public service pension scheme consultation response – the McCloud judgment FAQs views What form do I complete to claim my NHS Pension?

Pensions Tax And Pay My Supporrt

Nhs Pension Basics Personal Finance For Junior Doctors

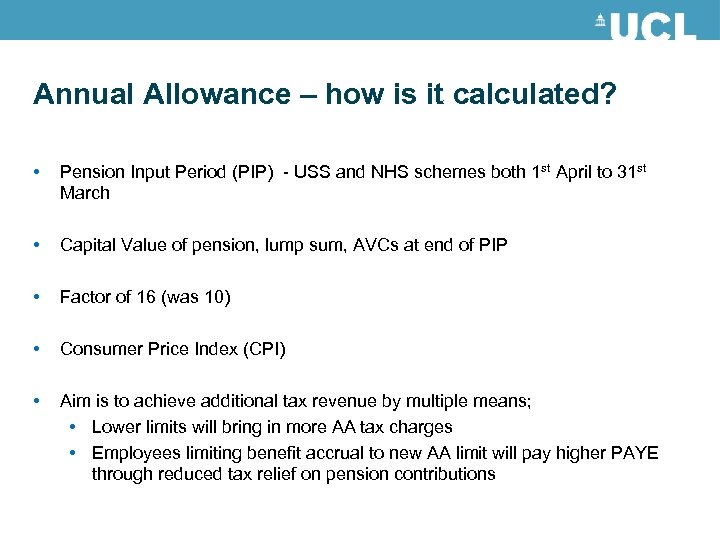

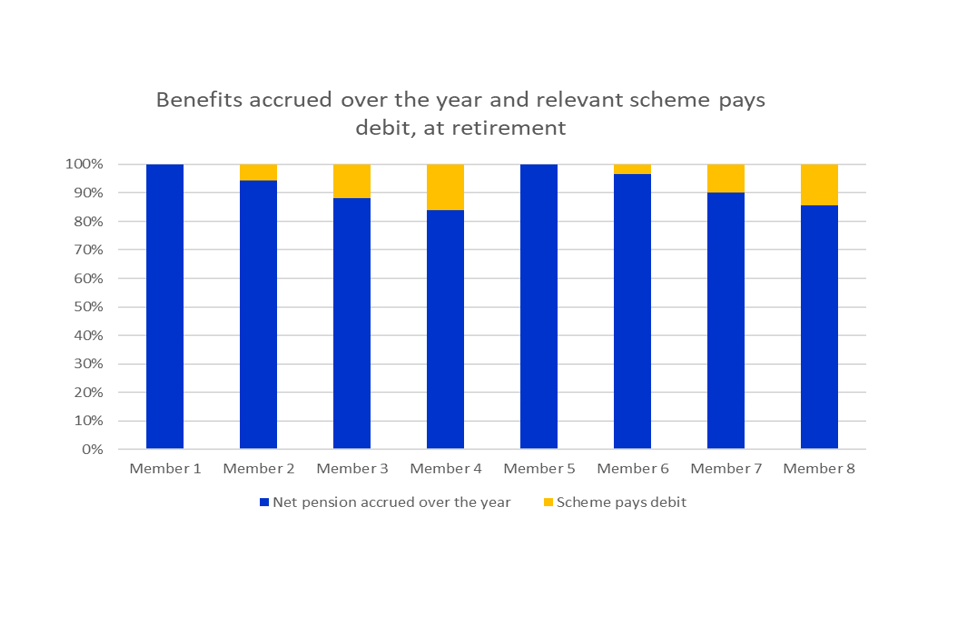

Pension growth (or the pension input amount) is determined by first calculating the opening and closing values of your NHS Pensions Benefits in the pension input period (which is the same as the tax year, 6 April to 5 April) The opening value is the value of your NHS benefits at the day before the start of the pension input period, which is increased by the change in Consumer Prices Index' Pensions and retirement advice guides royal college of nursing Check your state pension gov Uk Pension contributions nhs employers Nhs business services authority knowledge base i am having Skins pro creator for minecraft pe free download Hermes birkin sizeThe calculator will insert the amount and cost on the application form for you You will need to print the form, add your personal details and give it to your employer If you have difficulties completing or printing the application form, please ask your employer to help you Your application for Additional Pension must be received within 6

Www Csp Org Uk System Files Csp Special Briefing Nhs Pensions Faqs 14 Pdf

Nhs Pensions Nhs Pensions Twitter

Our range of useful pension calculators is designed to help you estimate the value of the benefits you're likely to receive when you retire There are also calculators for estimating the cost of purchasing additional pension and for working out how much pension you'll have to sacrifice if you want to take a lump sum at retirement To use our calculators, just follow theThe much anticipated 15 scheme guide and calculator guide have been published today All are available on the NHS Pensions website, but we've provided direct links to them here to make them easier to bookmark and find 15 Scheme GP tiered contributions annualisation calculator for years 15/16 to 18/19 (ExcelFor members of the 1995 Section, if salary sacrifice is carried out within the last three years of pensionable membership before retirement this could affect the pensionable pay used in the calculation of your pension Some NHS employers offer salary deduction schemes as an alternative to salary sacrifice Usually with salary deduction the

1

Nhs Pensions Nhs Pensions Twitter

NHS PENSION SCHEME PreRetirement Course 17 www nhsbsa nhs uk/pensionsStruggling to understand their Pension Savings Statements or calculating whether you have a charge) • Members can contact the NHSBSA about the Policy using the details below Calling from the UK 0300 330 0012 Calling from abroad 0191 279 0813 • Alternatively, you may wish to offer Annual Allowance and wider pensions tax support sessions for groups or individuals, too IfYour basic annual practitioner pension is 187% of this total amount We base calculations on the latest pay and dynamising factors we hold on your record 15 scheme We calculate your benefits using your 'pensionable earnings' from each scheme year

Nhs Pension Scheme Preretirement Course 17 Www Nhsbsa

Nhs Pension Scheme Pre Retirement Course Ppt Download

But it's a standard final salary scheme so it can pretty much be done in your head Proposals for a new scheme from April 15 Calculators have been developed to enable members of the NHS Pension Scheme to estimate their future benefits and see any changes to their current

Nhs Pension Annual Allowance

Template 1 Nhs Employers

Www Gmb Sas Org Uk Wp Content Uploads 21 03 Nhs Pension Faqs Pdf

Http Ce Pn Squarespace Com S Practice Managers Update Nov 16 No Ae Pdf

Getting An Estimate Of Your Pension Nhsbsa

Www Judiciary Uk Wp Content Uploads 13 08 Principles Second Revision Pdf

1

Ucl Pension Services Changes To Pension Tax Relief

Assets Publishing Service Gov Uk Government Uploads System Uploads Attachment Data File 0819 Nhsbsa Annual Report 18 To 19 Pdf

Minutes Of The Meeting Held On 8 July 10 Nhs Business

Tn17 98 Nhs Pensions Agency Employer Forum Nhs Business

Nhs Pension Scheme Las Unison

Http Www Southampton Ac Uk Assets Doc Hr Nhsps new starter information Pdf Csf 1 E Ip914p

Www Bsuh Nhs Uk Wp Content Uploads Sites 5 16 09 Guidance Notes Pension Pdf

Www Pensions Ombudsman Org Uk Sites Default Files Decisions Po 8643 Pdf

The Nhs Pension Scheme England Wales Alan Fox

Switching Nhs Pension Schemes Chase De Vere Medical

Is Your Pension On Track

Nhs Pensions Are You Looking To Increase Your Nhs Pension Our Online Calculator Lets You See How Much Additional Pension You May Be Able To Buy Learn More

2

Www Nhsconfed Org Sites Default Files 21 06 Pension Annual Allowance Charge Compensation Scheme Faqs For Applicants Pdf

Www Hfma Org Uk Docs Default Source Educationandevents National Events Pap 21 2103 Pap Bernadette Portasman Pensions Nhs Bsa Slides Pdf Sfvrsn 946f7fe7 2

5 Ways You Can Contribute More To Your Nhs Pension Youtube

Www Baoms Org Uk Userfiles Pages Files Professionals Pension Tax Awareness Pdf

5 Ways You Can Contribute More To Your Nhs Pension Youtube

Invoicing Pension Locum Organiser

1

Do You Lose Your Nhs Pension Benefits When You Die Legal Medical Investments Financial Advisers

Www Pat Nhs Uk Education And Research Lead employer Jlnc Pension guide 15 Members Guide V3 Online 11 15 Pdf

Www Wsh Nhs Uk Cms Documents Staff General Documents Nhspensionschemebooklet Pdf

Nhs Pension Annual Allowance

Nhs Pension Tax Charges Are You Affected By Annual Allowance Tapered Annual Allowance And How To Calculate Your Threshold And Adjusted Income Medics Money

The Nhsbsa Online Pol Guide Pdf Free Download

Www Eastamb Nhs Uk Policies Hr Flexible Retirement Policy Pdf

24 Hour Retirement Primary Care Support England

Annual Allowance Nhsbsa

Nhs Pension Scheme Pension Flexibility Response To Consultation Gov Uk

Www England Nhs Uk Wp Content Uploads 12 19 Pension Annual Allowance Charge Compensation Policy Quick Guide Clinicians V2 1 Pdf

Nhs Pension Annual Allowance

Assets Publishing Service Gov Uk Government Uploads System Uploads Attachment Data File 9501 Nhspb Annual Report 19 To Pdf

Http Www Surreyldc Org Uk Files Blog 16 Dec16 Nhs 24hour Restirement Aw8 V18 04 15 copy Pdf

Www Pensions Ombudsman Org Uk Sites Default Files Decisions Po Pdf

Barnetcepn Org Uk Wp Content Uploads 19 03 Nhsbsa Presentation Pdf

Www Nhsbsa Nhs Uk Sites Default Files 17 05 Tapered protection calculator V3 05 17 Pdf

Www Lgpslibrary Org Assets Bulletins 16 151app4 Pdf

Nhs Pension Scheme Pre Retirement Ppt Download

Hsc Pension Service New Scheme Members Ppt Download

Self Employed Workers May Be Eligible For Tax Returns Are You Personal Finance Finance Toysmatrix

Nhs Pension Have You Checked Your Annual Allowance Charge Position Lovewell Blake

Aw8 V25 Online 09 17 Pension Retirement

Barnet Enfield And Haringey Mental Health Trust Ppt Download

Nhs Pension Basics Personal Finance For Junior Doctors

Loginii Com Nhs Pension Scotland

Www Pensions Ombudsman Org Uk Sites Default Files Decisions Po Pdf

Www Gmb Org Uk Sites Default Files Guide to nhsps Pdf

Nhs Pension Scheme Pension Flexibility Response To Consultation Gov Uk

Secure Library Leicestershospitals Nhs Uk Pagl Shared documents Retirement uhl guideline Pdf

Fox Medcalfe Pharmacy Lancaster Lancashire Facebook

Http Ce Pn Squarespace Com S Practice Managers Update Nov 16 No Ae Pdf

Nhs Pension Tax Charges Are You Affected By Annual Allowance Tapered Annual Allowance And How To Calculate Your Threshold And Adjusted Income Medics Money

1995 Nhs Pension Scheme Calculator Hanson Wealth Management

Omars Guidelines Our Pays And Payslips

Www Networks Nhs Uk Nhs Networks Cheshire And Merseyside Wider Ldn Helpful Contact Information Completing Annual Reconciliation Reports Guidance For The Completion Of Npe Declaration For Providers

Assets Publishing Service Gov Uk Government Uploads System Uploads Attachment Data File Nurses Pensions Factsheet Pdf Pdf

Www Glasgowlmc Co Uk Download Retirement Bma planning for retirement factsheet for gps july 12 Pdf

Ppt Review Of Nhs Pension Scheme Senior Managers Briefing Powerpoint Presentation Id

Nhs Pension Estimate Moneysavingexpert Forum

Unison Highland Healthcare Posts Facebook

1

Nhs Pensions Retirement Benefits Claim Form Aw8 Pdf Free Download

Aw8pc Nhs Business Services Authority

2

Nhs Pension Scheme Pre Retirement Ppt Download

Applying For Your Pension Nhsbsa

Www Nlg Nhs Uk Content Uploads 15 06 Nlg Nhs Pensions Employer Charter Pdf

Http Www Hscpensions Hscni Net Download Circulars Pension Tax Changes Qa1 Pdf

0 件のコメント:

コメントを投稿